Your Can you get conventional loan on mobile images are available in this site. Can you get conventional loan on mobile are a topic that is being searched for and liked by netizens today. You can Find and Download the Can you get conventional loan on mobile files here. Find and Download all free photos and vectors.

If you’re searching for can you get conventional loan on mobile pictures information connected with to the can you get conventional loan on mobile topic, you have pay a visit to the ideal blog. Our site always provides you with suggestions for viewing the highest quality video and picture content, please kindly surf and locate more informative video articles and graphics that fit your interests.

Can You Get Conventional Loan On Mobile. Buy a mobile home even if it doesnt conform to traditional mortgage standards like being more than 400 square feet or it was built before 1976. If you need a loan to purchase land though it wont feature the same terms and conditions youd receive with a standard mortgage. Its called baseline because the maximum amountor limit you can borrow is adjusted every year to match housing-price changes. Borrowers may qualify to put down as little as 35 on a mobile home purchase making hom ownership an option for many who would otherwise have to wait several years as they saved enough for a larger down payment.

7 Genius Functions On The Fnb Mobile App Banking App Mobile App Mobile Banking From pinterest.com

7 Genius Functions On The Fnb Mobile App Banking App Mobile App Mobile Banking From pinterest.com

For example if you choose to make a 20 percent down payment youll enjoy immediate equity in your home and avoid paying private mortgage insurance PMI. Also referred to as personal property loans chattel loans make possible the purchase of manufactured homes that will be placed on land home buyers own outright or are still paying for or on rental sites within manufactured home communities. Borrowers may qualify to put down as little as 35 on a mobile home purchase making hom ownership an option for many who would otherwise have to wait several years as they saved enough for a larger down payment. However if you can qualify for this type of loan there are some significant advantages. The best thing is that your home has a permanent foundation as a result of which it is easier to qualify for loans on mobile homes. However there are a few select lenders nationwide that have the ability to see through the perceived risk and provide financing to mobile homeowners.

For example if you choose to make a 20 percent down payment youll enjoy immediate equity in your home and avoid paying private mortgage insurance PMI.

Conventional loans are a popular mortgage option that typically costs less than other comparable loans. The best thing is that your home has a permanent foundation as a result of which it is easier to qualify for loans on mobile homes. However most lenders will have strict requirements that you need to adhere to in order to receive a loan. However there are a few select lenders nationwide that have the ability to see through the perceived risk and provide financing to mobile homeowners. Conventional loans are a popular mortgage option that typically costs less than other comparable loans. As with other FHA mortgages there are caps on the loan amount for manufactured homes.

Source: pinterest.com

Source: pinterest.com

If your mobile home is at least 400 square feet on an approved permanent foundation and taxed as real property you can apply for conventional or government-backed mortgages. However if you can qualify for this type of loan there are some significant advantages. This is one of the main reasons buyers decide to secure a conventional loan. Because this is an FHA loan product the down payment requirement is typically lower than with many comparable conventional loan programs. Most mobile homes are sold through local retailers and dealers which are typically good sources of referrals for both conventional and FHA mortgage providers.

Source: tr.pinterest.com

Source: tr.pinterest.com

However if you can qualify for this type of loan there are some significant advantages. A conventional loan offers you the flexibility to make a small or larger down payment depending on your needs. Most mobile homes are sold through local retailers and dealers which are typically good sources of referrals for both conventional and FHA mortgage providers. The minimum credit scores required for different mobile home loans vary according to lenders specific requirements. Your financing will also depend on.

Source: id.pinterest.com

Source: id.pinterest.com

However with any down payment less than 20 percent youll have to pay for PMI until you. However with any down payment less than 20 percent youll have to pay for PMI until you. The most beneficial being that no mortgage insurance is required for borrowers that put down at least 20. Instead of getting one loan for 80 of the purchase price which would require a 20 down payment you will get a separate loan for 10 LTV leaving you just needing to put 10 down and avoiding mortgage insurance. The best thing is that your home has a permanent foundation as a result of which it is easier to qualify for loans on mobile homes.

Source: ar.pinterest.com

Source: ar.pinterest.com

The most beneficial being that no mortgage insurance is required for borrowers that put down at least 20. Also referred to as personal property loans chattel loans make possible the purchase of manufactured homes that will be placed on land home buyers own outright or are still paying for or on rental sites within manufactured home communities. Contrary to what you may believe this is always an option. As with other FHA. The most beneficial being that no mortgage insurance is required for borrowers that put down at least 20.

Source: pinterest.com

Source: pinterest.com

On the flip side you may qualify for a conventional loan with a down payment as low as three percent. Instead of getting one loan for 80 of the purchase price which would require a 20 down payment you will get a separate loan for 10 LTV leaving you just needing to put 10 down and avoiding mortgage insurance. Your financing will also depend on. This is one of the main reasons buyers decide to secure a conventional loan. Maximum loan amounts are up to 50000 but can.

Source: pinterest.com

Source: pinterest.com

Contrary to what you may believe this is always an option. Its called baseline because the maximum amountor limit you can borrow is adjusted every year to match housing-price changes. Just to prove our point that it is possible to finance a mobile home we will start with a conventional mortgage. However most lenders will have strict requirements that you need to adhere to in order to receive a loan. A conventional loan offers you the flexibility to make a small or larger down payment depending on your needs.

Source: pinterest.com

Source: pinterest.com

Conventional mortgages on the other hand allow purchasers to buy a. The minimum credit scores required for different mobile home loans vary according to lenders specific requirements. If you need a loan to purchase land though it wont feature the same terms and conditions youd receive with a standard mortgage. Instead of getting one loan for 80 of the purchase price which would require a 20 down payment you will get a separate loan for 10 LTV leaving you just needing to put 10 down and avoiding mortgage insurance. Contrary to what you may believe this is always an option.

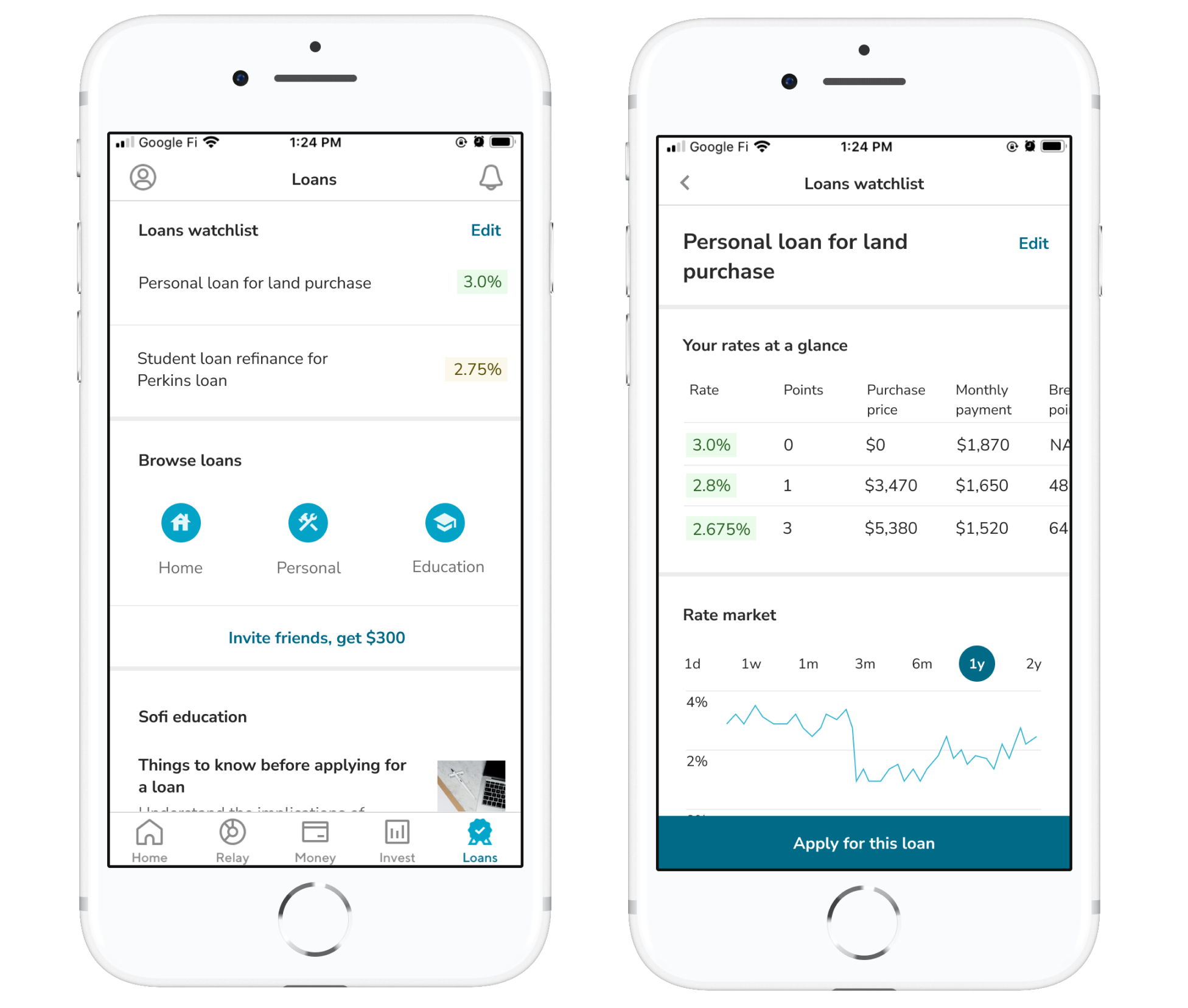

Source: medium.com

Source: medium.com

For example conventional mortgage lenders usually require a. However if you can qualify for this type of loan there are some significant advantages. Maximum loan amounts are up to 50000 but can. A piggyback loan is a creative way to get a conventional home loan with no PMI while putting less than 20 down. On the flip side you may qualify for a conventional loan with a down payment as low as three percent.

Source: br.pinterest.com

Source: br.pinterest.com

The minimum credit scores required for different mobile home loans vary according to lenders specific requirements. The minimum credit scores required for different mobile home loans vary according to lenders specific requirements. On the flip side you may qualify for a conventional loan with a down payment as low as three percent. Conventional loans are a popular mortgage option that typically costs less than other comparable loans. Manufactured homes can be financed with either chattel or mortgage loans.

Source: pinterest.com

Source: pinterest.com

In certain high-cost areas the loan limit may increase to a maximum of 679650. Borrowers may qualify to put down as little as 35 on a mobile home purchase making hom ownership an option for many who would otherwise have to wait several years as they saved enough for a larger down payment. The best thing is that your home has a permanent foundation as a result of which it is easier to qualify for loans on mobile homes. Manufactured homes can be financed with either chattel or mortgage loans. If you need a loan to purchase land though it wont feature the same terms and conditions youd receive with a standard mortgage.

Source: br.pinterest.com

Source: br.pinterest.com

Hi Shell It is possible to get 100 financing for a 1985 mobile home. The most beneficial being that no mortgage insurance is required for borrowers that put down at least 20. For example conventional mortgage lenders usually require a. This is one of the main reasons buyers decide to secure a conventional loan. But the lender will obviousdly conisder your financial status and credit before approving any mobile home loan.

Source: pinterest.com

Source: pinterest.com

In most cases interest rates start a few points higher than conventional loans because mobile homes tend to depreciate so we looked at interest rate ranges for the lenders to make. For example conventional mortgage lenders usually require a. For example if you choose to make a 20 percent down payment youll enjoy immediate equity in your home and avoid paying private mortgage insurance PMI. However there are a few select lenders nationwide that have the ability to see through the perceived risk and provide financing to mobile homeowners. The minimum credit scores required for different mobile home loans vary according to lenders specific requirements.

Source: medium.com

Source: medium.com

In most cases interest rates start a few points higher than conventional loans because mobile homes tend to depreciate so we looked at interest rate ranges for the lenders to make. Banks and credit unions as conventional lenders are more prone to decline home equity loan and line of credit applications for mobile homes because of the risk of depreciation. Manufactured homes can be financed with either chattel or mortgage loans. Most mobile homes are sold through local retailers and dealers which are typically good sources of referrals for both conventional and FHA mortgage providers. Buy a mobile home even if it doesnt conform to traditional mortgage standards like being more than 400 square feet or it was built before 1976.

Source: pinterest.com

Source: pinterest.com

In most cases interest rates start a few points higher than conventional loans because mobile homes tend to depreciate so we looked at interest rate ranges for the lenders to make. As with other FHA mortgages there are caps on the loan amount for manufactured homes. For example if you choose to make a 20 percent down payment youll enjoy immediate equity in your home and avoid paying private mortgage insurance PMI. It may be harder to qualify for a conventional loan due to stricter credit and income requirements. Its called baseline because the maximum amountor limit you can borrow is adjusted every year to match housing-price changes.

Source: in.pinterest.com

Source: in.pinterest.com

Maximum loan amounts are up to 50000 but can. On the flip side you may qualify for a conventional loan with a down payment as low as three percent. Just to prove our point that it is possible to finance a mobile home we will start with a conventional mortgage. Maximum loan amounts are up to 50000 but can. Conventional mortgages on the other hand allow purchasers to buy a.

Source: pinterest.com

Source: pinterest.com

The most beneficial being that no mortgage insurance is required for borrowers that put down at least 20. However most lenders will have strict requirements that you need to adhere to in order to receive a loan. A conventional loan offers you the flexibility to make a small or larger down payment depending on your needs. Hi Shell It is possible to get 100 financing for a 1985 mobile home. Instead of getting one loan for 80 of the purchase price which would require a 20 down payment you will get a separate loan for 10 LTV leaving you just needing to put 10 down and avoiding mortgage insurance.

Source: in.pinterest.com

Source: in.pinterest.com

This is one of the main reasons buyers decide to secure a conventional loan. In certain high-cost areas the loan limit may increase to a maximum of 679650. For example if you choose to make a 20 percent down payment youll enjoy immediate equity in your home and avoid paying private mortgage insurance PMI. Its called baseline because the maximum amountor limit you can borrow is adjusted every year to match housing-price changes. Conventional loans are a popular mortgage option that typically costs less than other comparable loans.

Source: it.pinterest.com

Source: it.pinterest.com

As with other FHA. Banks and credit unions as conventional lenders are more prone to decline home equity loan and line of credit applications for mobile homes because of the risk of depreciation. A piggyback loan is a creative way to get a conventional home loan with no PMI while putting less than 20 down. The different types of mobile homes. Currently the most you can borrow is 69678 for the home itself and 23226 for a lot.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can you get conventional loan on mobile by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.