Your Can you claim mobile home on your taxes images are available in this site. Can you claim mobile home on your taxes are a topic that is being searched for and liked by netizens today. You can Find and Download the Can you claim mobile home on your taxes files here. Get all royalty-free photos.

If you’re searching for can you claim mobile home on your taxes pictures information related to the can you claim mobile home on your taxes keyword, you have pay a visit to the ideal site. Our site frequently provides you with hints for seeing the highest quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

Can You Claim Mobile Home On Your Taxes. Also if you prepaid points at closing for your mobile home which helps reduce your interest rate you can deduct that amount in the year you. Yes you can deduct the portion of your family plan cell phone costs that is business usage. Whether youre renting or purchasing land to build a new mobile home property you need to factor in the taxes. You may also qualify for mobile home park depreciation in some situations if so it might be worth your time to learn more about utility trailer depreciation rates.

Stimulus Check Fine Print This Is Why You Got The Payment Size You Did In 2021 Adjusted Gross Income Filing Taxes Budgeting Finances From pinterest.com

Stimulus Check Fine Print This Is Why You Got The Payment Size You Did In 2021 Adjusted Gross Income Filing Taxes Budgeting Finances From pinterest.com

Armed Forces and you had to move because of a permanent change of station. The answer to question depends on the price of mobile phone. Travel expenses for military reserve members. To deduct property tax on a Federal tax return your name must be on the title of the property. Similarly if you pay for your usage and are then reimbursed by your employer you cant claim a deduction. To qualify the mobile home must be your main home and you must own and live in the home for a total of two.

KathieC As Carl said - that is not deductible.

If you rely on a mobile home as your primary form of residence the chances are high that you will be able to identify a number of valuable tax deductions for this property. You can deduct moving expenses on your taxes if youre an active-duty member of the US. KathieC As Carl said - that is not deductible. Charges for improvements such as sidewalks and sewer that serve your property but not others are not eligible. Teachers get up to 250 of qualified expenses per year 500 if married and filing jointly if both spouses are eligible educators but not more than 250 each. Costs you incur before work commences.

Source: pinterest.com

Source: pinterest.com

If you stocked up on face masks and hand sanitizer in 2020 to combat the COVID-19 pandemic the IRS has good news. The manufactured home itself serves as collateral for the loan youve taken out to purchase the property. The costs incurred for business calls made using your personal mobile can be claimed as an expense. KathieC As Carl said - that is not deductible. Teachers get up to 250 of qualified expenses per year 500 if married and filing jointly if both spouses are eligible educators but not more than 250 each.

Source: pinterest.com

Source: pinterest.com

You may also be able to deduct the interest on your manufactured home loan if the home is used for other deductible purposes eg. If you are registered for GST you can claim a credit for any GST included in the price of a mobile device or data purchased for use in your business. Florida does not have a personal income tax so there are no state income tax return deduction to enter for rent paid in FloridaRent paid is not entered on a federal tax return. Teachers get up to 250 of qualified expenses per year 500 if married and filing jointly if both spouses are eligible educators but not more than 250 each. Charges for improvements such as sidewalks and sewer that serve your property but not others are not eligible.

Source: pinterest.com

Source: pinterest.com

If youre a teacher you can claim unreimbursed expenses for PPE purchases made after March 12 2020 as an Educator Expense Deduction. If its fixed to the ground youll claim the expense as a real estate tax on line 6 of. If you rely on a mobile home as your primary form of residence the chances are high that you will be able to identify a number of valuable tax deductions for this property. If your office accounts for say 20 of. If you stocked up on face masks and hand sanitizer in 2020 to combat the COVID-19 pandemic the IRS has good news.

Source: pinterest.com

Source: pinterest.com

Furthermore can I claim Lot rent on taxes in Florida. If your employer provides you with a phone for work use and they are billed for the usage phone calls text messages data then you cant claim a deduction. Similarly if you pay for your usage and are then reimbursed by your employer you cant claim a deduction. But dont worry well break it down. If you stocked up on face masks and hand sanitizer in 2020 to combat the COVID-19 pandemic the IRS has good news.

Source: pinterest.com

Source: pinterest.com

This is a deduction you can take without having to itemize your taxes so you dont have to. If its fixed to the ground youll claim the expense as a real estate tax on line 6 of. The deduction you may be able to claim on your tax return depends on whether or not. However the answer must go deeper as things are slightly more complicated than that. But dont worry well break it down.

Source: pinterest.com

Source: pinterest.com

If you rely on a mobile home as your primary form of residence the chances are high that you will be able to identify a number of valuable tax deductions for this property. While youre itemizing your deductions you can also write off any property tax you pay on your mobile home. You may also be able to deduct the interest on your manufactured home loan if the home is used for other deductible purposes eg. The easiest way to determine this would be to obtain an itemized version of your monthly cell phone bill. You can deduct those expenses off your tax return this year.

If its fixed to the ground youll claim the expense as a real estate tax on line 6 of. If you own the land on which your mobile home is situated you can deduct property taxes. Also if you prepaid points at closing for your mobile home which helps reduce your interest rate you can deduct that amount in the year you. However the answer must go deeper as things are slightly more complicated than that. If you rely on a mobile home as your primary form of residence the chances are high that you will be able to identify a number of valuable tax deductions for this property.

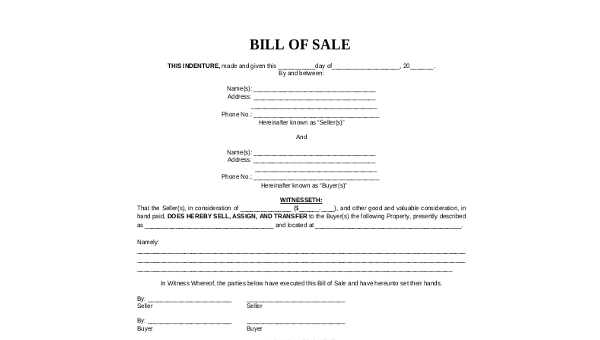

Source: sampleforms.com

Source: sampleforms.com

Teachers get up to 250 of qualified expenses per year 500 if married and filing jointly if both spouses are eligible educators but not more than 250 each. If you are registered for GST you can claim a credit for any GST included in the price of a mobile device or data purchased for use in your business. Armed Forces and you had to move because of a permanent change of station. If your office accounts for say 20 of. Florida does not have a personal income tax so there are no state income tax return deduction to enter for rent paid in FloridaRent paid is not entered on a federal tax return.

Source: in.pinterest.com

Source: in.pinterest.com

If you stocked up on face masks and hand sanitizer in 2020 to combat the COVID-19 pandemic the IRS has good news. Likewise if you rent a mobile home lot there will be certain deductions available to you that the actual owners of the lot cannot claim. To qualify the taxes must be based on the value of the home and the taxes must be assessed to all property owners. If you own the land on which your mobile home is situated you can deduct property taxes. This is a deduction you can take without having to itemize your taxes so you dont have to.

Source: ar.pinterest.com

Source: ar.pinterest.com

Regardless of what loopholes you try to find yes mobile home owners do pay property taxes. Whether your mobile home is real or personal property you can deduct property taxes. If you use your home to conduct your work you can claim a proportion of all your household bills gas electricity water and council tax against your bill. For a mobile home located on land you own it is considered real property and therefore you will pay real estate tax. Additionally how much does it cost to live in a mobile home park.

Source: pinterest.com

Source: pinterest.com

If your office accounts for say 20 of. Armed Forces and you had to move because of a permanent change of station. Whether your mobile home is real or personal property you can deduct property taxes. The costs incurred for business calls made using your personal mobile can be claimed as an expense. If youre a teacher you can claim unreimbursed expenses for PPE purchases made after March 12 2020 as an Educator Expense Deduction.

Source: pinterest.com

Source: pinterest.com

But dont worry well break it down. The home is used as a primary or secondary residence. Whether your mobile home is real or personal property you can deduct property taxes. The answer to question depends on the price of mobile phone. Whether youre renting or purchasing land to build a new mobile home property you need to factor in the taxes.

Florida does not have a personal income tax so there are no state income tax return deduction to enter for rent paid in FloridaRent paid is not entered on a federal tax return. Similarly if you pay for your usage and are then reimbursed by your employer you cant claim a deduction. Whether your mobile home is real or personal property you can deduct property taxes. Likewise if you rent a mobile home lot there will be certain deductions available to you that the actual owners of the lot cannot claim. The Internal Revenue Code allows homeowners to exclude up to 250000 of the resulting gain from capital gains tax if certain requirements are met.

Source: pinterest.com

Source: pinterest.com

This is a deduction you can take without having to itemize your taxes so you dont have to. If you own the land on which your mobile home is situated you can deduct property taxes. Costs you incur before work commences. You can only claim the business portion of the expenses if the mobile devices are used for both business and private uses. For a mobile home located on land you own it is considered real property and therefore you will pay real estate tax.

Source: br.pinterest.com

Source: br.pinterest.com

The Internal Revenue Code allows homeowners to exclude up to 250000 of the resulting gain from capital gains tax if certain requirements are met. Yes you can deduct the portion of your family plan cell phone costs that is business usage. Whether youre renting or purchasing land to build a new mobile home property you need to factor in the taxes. If your mobile phone purchase and the contract is made in your name you wont be able to claim the cost of the mobile phone or the monthly tariff. The easiest way to determine this would be to obtain an itemized version of your monthly cell phone bill.

Source: pinterest.com

Source: pinterest.com

This is a deduction you can take without having to itemize your taxes so you dont have to. Yes you can deduct the portion of your family plan cell phone costs that is business usage. Armed Forces and you had to move because of a permanent change of station. You can deduct moving expenses on your taxes if youre an active-duty member of the US. Florida does not have a personal income tax so there are no state income tax return deduction to enter for rent paid in FloridaRent paid is not entered on a federal tax return.

Source: pinterest.com

Source: pinterest.com

To deduct property tax on a Federal tax return your name must be on the title of the property. While youre itemizing your deductions you can also write off any property tax you pay on your mobile home. This also applies if youve purchased a PAYG mobile. You can deduct those expenses off your tax return this year. To qualify the taxes must be based on the value of the home and the taxes must be assessed to all property owners.

Source: pinterest.com

Source: pinterest.com

Also if you prepaid points at closing for your mobile home which helps reduce your interest rate you can deduct that amount in the year you. For a mobile home located on land you own it is considered real property and therefore you will pay real estate tax. You can write off the part you pay at closing in the year you. If your employer provides you with a phone for work use and they are billed for the usage phone calls text messages data then you cant claim a deduction. Armed Forces and you had to move because of a permanent change of station.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can you claim mobile home on your taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.