Your Can u have cosigner on home loan images are available. Can u have cosigner on home loan are a topic that is being searched for and liked by netizens now. You can Find and Download the Can u have cosigner on home loan files here. Download all free photos.

If you’re searching for can u have cosigner on home loan pictures information connected with to the can u have cosigner on home loan topic, you have pay a visit to the right blog. Our site always provides you with hints for downloading the maximum quality video and image content, please kindly surf and locate more enlightening video content and images that fit your interests.

Can U Have Cosigner On Home Loan. The same goes for co-borrowers since you can only have two names on a vehicle title. If you fall into this category its a good idea to understand who can co-sign on your VA loan and how it might affect your. A co-signer is not applying to use any of the money in the loan. They must have at least a 580 credit score to cosign for a loan with 35 percent down payment and have at least a 500 to qualify for 10 percent down financing with.

How To Get A Student Loan Without A Co Signer Forbes Advisor From forbes.com

How To Get A Student Loan Without A Co Signer Forbes Advisor From forbes.com

However you can only ask one cosigner to sign on a car loan. Likewise most lenders require FHA borrowers to have minimum credit scores of between 580 and 620. Even though a cosigner isnt on the title and doesnt have any rights to the car. If youre applying for an FHA home loan you arent forced to apply and be responsible for the debt all by yourself–FHA rules allow a co-borrower or cosigner to apply alongside the borrower. Generally speaking a cosigner will be on the loan documents such as the note and the mortgage and deed of trust. Find out if youre eligible for this.

A co-signer is not applying to use any of the money in the loan.

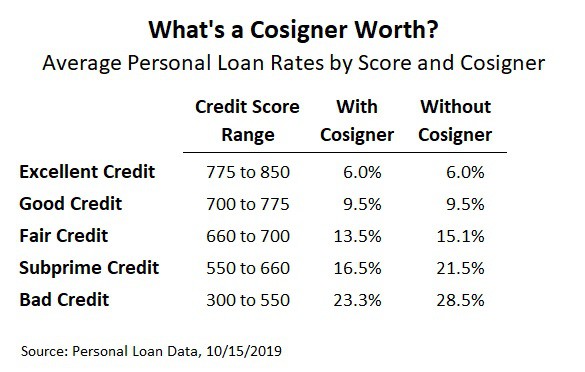

If you can find a co-signer with a low debt-to-income ratio DTI you may be able to revive your flagging home ownership dreams because the lender looks at your combined income levels. It doesnt matter to the lender whether one or both of you make the payments as long as theyre paid. Some view co-signing on a mortgage or home equity loan as much less dangerous than doing so on a car loan or personal loan. However you can only ask one cosigner to sign on a car loan. They must have at least a 580 credit score to cosign for a loan with 35 percent down payment and have at least a 500 to qualify for 10 percent down financing with. The cosigners role is strictly on the loan application and not with ownership of the property.

Source: pinterest.com

Source: pinterest.com

One of the benefits of VA loans is that they allow veterans to secure home loans with lower interest rates and lower qualifications than a traditional loan. This is a slightly complicated issue but there are clear answers. If you fail to make the payments however it can take legal action against both of you. A co-signer helps a borrower get approved by adding their name to the application. This is because when you add a cosigner to a loan they lend you their good score which lowers the risk auto lenders face and can help get you approved for a loan.

Source: money.cnn.com

Source: money.cnn.com

The cosigner will not be on title to the property and will not sign the deed. Even though a cosigner isnt on the title and doesnt have any rights to the car. This is different from being a co-applicant. The cosigner will not be on title to the property and will not sign the deed. Mortgage lending is another area where co-signers are relatively common especially if the borrower is a first-time home buyer.

Source: pinterest.com

Source: pinterest.com

The same goes for co-borrowers since you can only have two names on a vehicle title. Some view co-signing on a mortgage or home equity loan as much less dangerous than doing so on a car loan or personal loan. Most types of loans will accept co-signers and the process is common with student loans and auto loans. Instead the co-signer guarantees that they will repay the loan if the borrower stops making payments or defaults entirely. But not everyone wants to buy a home all by themselves.

Source: usda-loans.com

Source: usda-loans.com

Find out if youre eligible for this. If you want a nonoccupant co-client on a conventional loan they need to sign on the homes loan and agree to repay the loan if the primary occupant falls through. No you cannot use your VA benefit to purchase a home for someone else. Likewise most lenders require FHA borrowers to have minimum credit scores of between 580 and 620. A co-signer helps a borrower get approved by adding their name to the application.

Source: studentloansherpa.com

Source: studentloansherpa.com

If you fall into this category its a good idea to understand who can co-sign on your VA loan and how it might affect your. If the lender determines the co-signer. A co-signer helps a borrower get approved by adding their name to the application. Some view co-signing on a mortgage or home equity loan as much less dangerous than doing so on a car loan or personal loan. It doesnt matter to the lender whether one or both of you make the payments as long as theyre paid.

Source: fool.com

Source: fool.com

If the lender determines the co-signer. Likewise most lenders require FHA borrowers to have minimum credit scores of between 580 and 620. The cosigners role is strictly on the loan application and not with ownership of the property. However the non-ccupant co-client doesnt need to be on the homes title. At that point the co-signer can request to be taken off the note by asking the lender to requalify the loan.

Source: studentloanhero.com

Source: studentloanhero.com

This is different from being a co-applicant. Even though a cosigner isnt on the title and doesnt have any rights to the car. This is because when you add a cosigner to a loan they lend you their good score which lowers the risk auto lenders face and can help get you approved for a loan. Veterans Can Buy a Home with 0 Down Sponsored The VA Home Loan offers 0 Down with no PMI. Once the loan is closed both you and the co-signer are on the hook for the payments.

Source: medium.com

Source: medium.com

The same goes for co-borrowers since you can only have two names on a vehicle title. At that point the co-signer can request to be taken off the note by asking the lender to requalify the loan. Using a them is also a way for a borrower with established credit to help a less. The cosigner will not be on title to the property and will not sign the deed. However the non-ccupant co-client doesnt need to be on the homes title.

Source: policygenius.com

Source: policygenius.com

If youre applying for an FHA home loan you arent forced to apply and be responsible for the debt all by yourself–FHA rules allow a co-borrower or cosigner to apply alongside the borrower. If eventually you wish to remove the co-signer you will have to prove that you can afford the payments on your own. Veterans Can Buy a Home with 0 Down Sponsored The VA Home Loan offers 0 Down with no PMI. If you want a nonoccupant co-client on a conventional loan they need to sign on the homes loan and agree to repay the loan if the primary occupant falls through. The cosigners role is strictly on the loan application and not with ownership of the property.

Source: studentloansherpa.com

Source: studentloansherpa.com

Even though a cosigner isnt on the title and doesnt have any rights to the car. A co-signer helps a borrower get approved by adding their name to the application. Some view co-signing on a mortgage or home equity loan as much less dangerous than doing so on a car loan or personal loan. Once the loan is closed both you and the co-signer are on the hook for the payments. But not everyone wants to buy a home all by themselves.

Source: studentloanhero.com

Source: studentloanhero.com

If you fall into this category its a good idea to understand who can co-sign on your VA loan and how it might affect your. Even with these lower qualifications however VA loan applicants sometimes still need a co-signer to qualify. Mortgage lending is another area where co-signers are relatively common especially if the borrower is a first-time home buyer. As long as the loan is active you are both responsible. Likewise most lenders require FHA borrowers to have minimum credit scores of between 580 and 620.

Source: ar.pinterest.com

Source: ar.pinterest.com

If you fall into this category its a good idea to understand who can co-sign on your VA loan and how it might affect your. As long as the loan is active you are both responsible. They must have at least a 580 credit score to cosign for a loan with 35 percent down payment and have at least a 500 to qualify for 10 percent down financing with. Mortgage lending is another area where co-signers are relatively common especially if the borrower is a first-time home buyer. This is because when you add a cosigner to a loan they lend you their good score which lowers the risk auto lenders face and can help get you approved for a loan.

Source: peerloansonline.com

Source: peerloansonline.com

Likewise most lenders require FHA borrowers to have minimum credit scores of between 580 and 620. One of the benefits of VA loans is that they allow veterans to secure home loans with lower interest rates and lower qualifications than a traditional loan. Veterans Can Buy a Home with 0 Down Sponsored The VA Home Loan offers 0 Down with no PMI. Once the loan is closed both you and the co-signer are on the hook for the payments. If you can find a co-signer with a low debt-to-income ratio DTI you may be able to revive your flagging home ownership dreams because the lender looks at your combined income levels.

Source: pinterest.com

Source: pinterest.com

The cosigners role is strictly on the loan application and not with ownership of the property. Generally speaking a cosigner will be on the loan documents such as the note and the mortgage and deed of trust. As is true of all co-signing situations the lender will. If you fall into this category its a good idea to understand who can co-sign on your VA loan and how it might affect your. If you fail to make the payments however it can take legal action against both of you.

Source: credit.com

Source: credit.com

At that point the co-signer can request to be taken off the note by asking the lender to requalify the loan. Mortgage lending is another area where co-signers are relatively common especially if the borrower is a first-time home buyer. They must have at least a 580 credit score to cosign for a loan with 35 percent down payment and have at least a 500 to qualify for 10 percent down financing with. It doesnt matter to the lender whether one or both of you make the payments as long as theyre paid. This is different from being a co-applicant.

Source: studentloanplanner.com

Source: studentloanplanner.com

Having a co-borrower or cosigner may improve the FHA loan applicants chances of getting approved for the mortgage. If eventually you wish to remove the co-signer you will have to prove that you can afford the payments on your own. Find out if youre eligible for this. This is because when you add a cosigner to a loan they lend you their good score which lowers the risk auto lenders face and can help get you approved for a loan. However the non-ccupant co-client doesnt need to be on the homes title.

Source: credit.com

Source: credit.com

If youre after a personal loan with cosigner Wells Fargo and Citibank have some options. The cosigner will not be on title to the property and will not sign the deed. It doesnt matter to the lender whether one or both of you make the payments as long as theyre paid. Once the loan is closed both you and the co-signer are on the hook for the payments. The same goes for co-borrowers since you can only have two names on a vehicle title.

Source: thecarconnection.com

Source: thecarconnection.com

The lender looks at both your credit and the nonoccupant co-clients credit to determine if you can get a loan. Even though a cosigner isnt on the title and doesnt have any rights to the car. Most types of loans will accept co-signers and the process is common with student loans and auto loans. However the non-ccupant co-client doesnt need to be on the homes title. Some view co-signing on a mortgage or home equity loan as much less dangerous than doing so on a car loan or personal loan.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can u have cosigner on home loan by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.